[ad_1]

UK home costs in September registered the largest month-to-month acquire in additional than 14 years because the stamp responsibility low cost got here to an finish whereas the “race for area” pushed consumers to look past London.

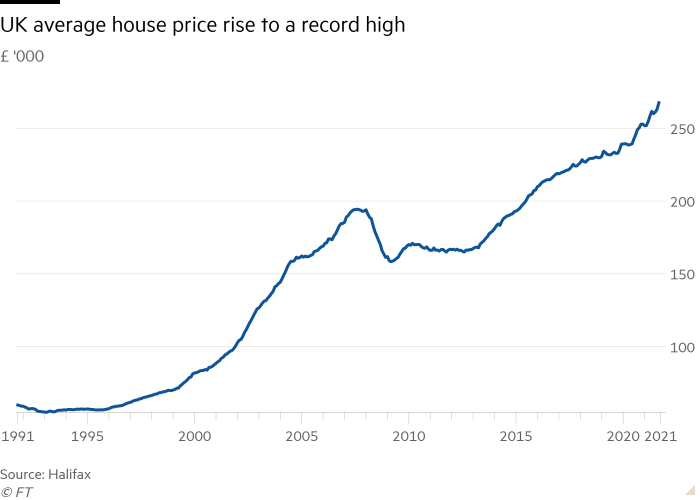

The typical home worth rose 1.7 per cent final month in contrast with August, the quickest month-to-month acquire since February 2007, in accordance with information from the mortgage supplier Halifax.

In contrast with the identical month final yr home costs had been up 7.4 per cent, an acceleration from 7.2 per cent within the earlier month, which pushed the typical home to simply over £267,500, the best on file.

September’s spike in costs “exhibits the pandemic growth remains to be alive and nicely”, stated Jonathan Hopper, chief government of Garrington Property Finders.

The top of the stamp responsibility vacation in England and a want amongst homebuyers to shut offers at velocity may have performed some half in these figures, stated Russell Galley, managing director at Halifax.

The quick rise displays different components as most mortgages agreed in September wouldn’t have been accomplished earlier than the tax break expired, he added.

From October, thresholds as much as which consumers in England and Northern Eire may keep away from paying stamp responsibility will decline from £250,000 to £125,000, the extent earlier than July 2020, when the tax vacation was launched to stimulate the housing market following the primary nationwide lockdown. Till July 1, the edge was £500,000.

“The ‘race-for-space’ as individuals modified their preferences and way of life selections undoubtedly had a serious influence,” stated Galley. Costs for residences rose 6.1 per cent, in contrast with 8.9 per cent for semi-detached properties and eight.8 per cent for indifferent.

Better London stays the outlier, with annual progress of simply 1 per cent and was once more the one area or nation to file a fall in home costs over the most recent rolling three-monthly interval.

“The driving power [of the price rise] is now old style market fundamentals, and the power imbalance of provide and demand,” stated Hopper.

[ad_2]

Source link

Neue Kommentare